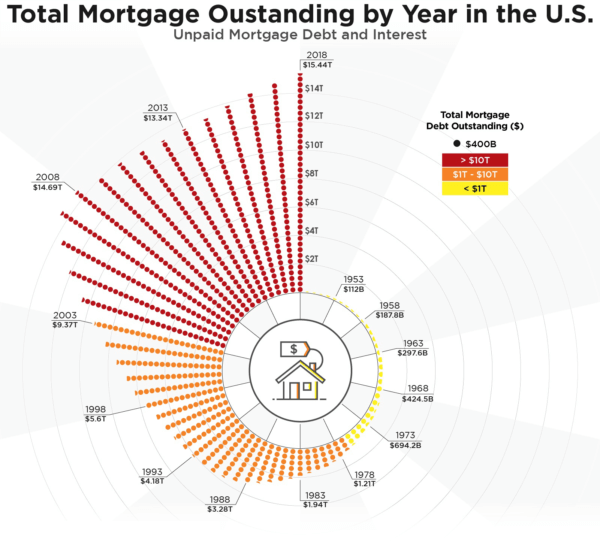

America’s Mortgage Debt Spiral Accelerates to All-Time High.

Since the 1940s, housing prices have soared to new levels. According to the U.S. Census Bureau, the median home value in the U.S. was $30,600 in 1940 (adjusted for inflation). By 2017, that number was $193,500. Not surprisingly, as housing prices increase, so does the amount of mortgage debt that a homebuyer must take on in order to afford a home. Our new visualization takes a closer look at how mortgage debt in the U.S. has changed over time.

* Outstanding mortgage debt is 284 times greater in 2018 than it was in 1949.

* Total mortgage debt first exceeded $1 trillion in 1977.

* From 2008 to 2012, during the height of the Great Recession, total mortgage debt in the U.S. actually decreased every year.

* As a percentage, the largest increase in mortgage debt year-over-year occurred from 1949 to 1950, when mortgage debt increased by more than 50%.

The visualization is based on data from the Federal Reserve, which lists the amount of outstanding mortgage debt in the U.S. since 1949. The chart above represents a timeline of mortgage debt, shown in circle form. The top of the circle starts with 1949, and the years progress in a clockwise direction until 2018, the most recent full year. For each year, the amount of outstanding mortgage debt is represented by smaller, stacked dots, with each dot representing $400 billion. To give a more complete picture of how much mortgage debt has been accruing over the years, the dots are color-coded. Years with yellow dots mean that the total mortgage debt is under $1 trillion, while orange dots represent $1 trillion to $10 trillion and the red dots represent more than $10 trillion in mortgage debt.

Evolution of the Mortgage Debt – Every Five Years

1953 – $112 billion

1958 – $187.8 billion

1963 – $297.6 billion

1968 – $424.5 billion

1973 – $694.2 billion

1978 – $1.21 trillion

1983 – $1.94 trillion

1988 – $3.28 trillion

1993 – $4.18 trillion

1998 – $5.6 trillion

2003 – $9.37 trillion

2008 – $14.69 trillion

2013 – $13.34 trillion

2018 – $15.44 trillion

Even though the mortgage debt is the highest in history, long-term interest rates are close to historical lows. Prominent economists, like Paul Krugman, have warned about the current real estate market status. Mortgage demand, despite record-low rates, seems unable to grow since home prices are still out of reach for many Americans.

While mortgage rates in the U.S. are low, other countries like Denmark are giving homebuyers even more of a boost. A Danish bank is offering the world’s first negative interest rate, at -0.5% a year, meaning the mortgage holders will pay back a lower amount than they took out to purchase a home. It will be interesting to see how this affects the Danish real estate market in the long run.

Information courtesy of HowMuch.net.

Ed Bertha

(941) 921.2117

EdBertha@DiscoverSuncoastHomes.com

www.DiscoverSuncoastHomes.com

Red Line Investors dba Burns & Bertha

2707 Barnard Road

Bradenton, FL 34207

Burns & Bertha – Changing Lives – Red Line Investors – © 2019

www.DiscoverSuncoastHomes.com